Brazil’s largest private bank, Itaú Unibanco, is set to launch an asset tokenization platform that transforms traditional finance products into tokens and to offer cryptocurrency custody services for its customers.

Cryptocurrency exchange CoinFLEX has partially restored user withdrawals, allowing them to withdraw up to 10% of their funds. Meanwhile, a filing from crypto lender Celsius has revealed the firm has a $1.2 billion hole in its balance sheet.

According to JPMorgan analysts, Bitcoin's production cost has dropped from around $24,000 at the start of June to around $13,000. The drop is associated with a decline in electricity use.

Top stories in the Crypto Roundup today:

- Brazil’s Largest Private Bank to Offer Crypto Custody Services

- CoinFLEX Limits Withdrawals, Celsius Filing Reveals $1.2 Billion Hole in Balance Sheet

- Bitcoin’s Cost of Production Dropped to $13,000: JPMorgan

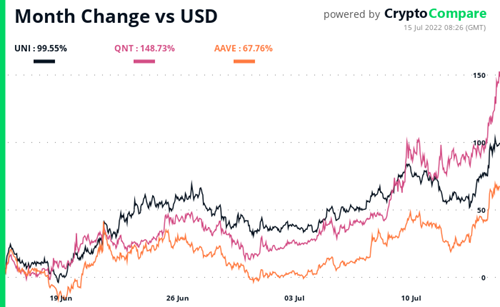

- Crypto Market Movers – UNI, QNT, AAVE