Data from blockchain analytics firm CryptoQuant has shown miners are rapidly offloading their Bitcoin holdings, with 14,000 BTC being moved out of wallets belonging to miners in a single 24-hour period.

Nasdaq-listed cryptocurrency exchange Coinbase has secured approval from financial regulators in Italy, allowing it to continue serving customers in the country.

Cryptocurrency hedge fund Three Arrows Capital has been revealed to owe $3.5 billion to 27 different companies, including Blockchain.com, Voyager Digital, and Genesis Global Trading. The figure comes from court documents from the bankruptcy and liquidation of the fund.

GAIM Ops West is the key gathering and networking event of the year for private asset managers covering alternative investment operations, compliance, and ODD. Join 300+ innovators shaping the industry and explore the latest trends and opportunities in digital transformation, ESG, private equity, and crypto.

Top stories in the Crypto Roundup today:

- Bitcoin Miners Offload Largest Amount of BTC Since Jan. 2021

- Coinbase Receives Regulatory Approval in Italy

- Crypto Hedge Fund Three Arrows Capital Owes $3.5 Billion to Creditors

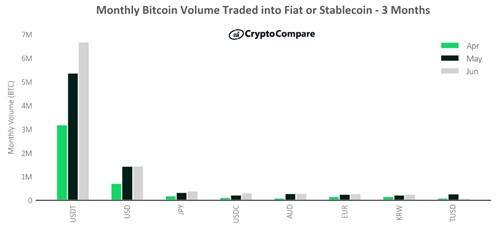

- Monthly Bitcoin Volume Traded into Fiat or Stablecoin

- GAIM Ops West: Connect with leaders in alternative investment operations, compliance, and due diligence.