The U.S. Securities and Exchange Commission (SEC) has used its insider-trading case against a former Coinbase product manager to formally declare nine digital assets as “securities” in its ongoing practice of defining its crypto oversight through enforcement actions.

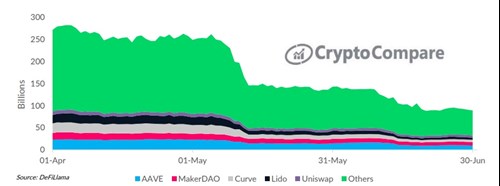

The year's second quarter was marred by high-profile contagion events within the digital assets ecosystem. Bitcoin and Ethereum lost 56.3% and 67.4% of their value, respectively, and the total value locked (TVL) in DeFi protocols plunged 65.7% to $93.2 billion.

Cryptocurrency market maker Cumberland has said institutional investors have been increasing their bets on Ethereum’s ether during the cryptocurrency’s rally this week.

CryptoCompare is delighted to announce the launch of its enhanced digital asset order book data product, providing users with unparalleled insight into the digital asset markets. Readers can generate an exclusive API key that allows them to trial the data for a limited time here.

Top stories in the Crypto Roundup today:

- SEC Calls 9 Cryptos ‘Securities’

- Total Value Locked on DeFi Keeps Dropping

- Institutions Long Ether as Ethereum’s Merge Approaches

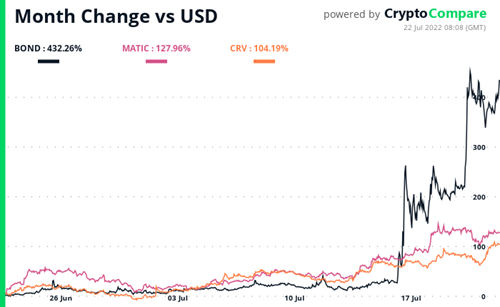

- Crypto Market Movers – BOND, MATIC, CRV

- CryptoCompare Launches Enhanced Order Book Data Product