The governance token of the rollup-based Layer-2 network Optimism has gone live. The token is set to shift the network’s structure by fueling the Optimism Collective, a governance system for funding composed of the Token House and the Citizens’ House.

Cryptocurrency companies have raised a record $30 billion of venture capital (VC) last year with the number of deals occurring in the sector remaining elevated even as digital asset prices fall, according to Morgan Stanley.

Russia’s central bank is said to be open to allowing the use of cryptocurrencies in international payments in what appears to be a possible relaxation of its opposition to digital assets.

Top stories in the Crypto Roundup today:

- Optimism’s Governance Token Goes Live

- Crypto Firms Raised $30 Billion of Venture Capital Last Year

- Russian Central Bank Open to Using Crypto for International Payments

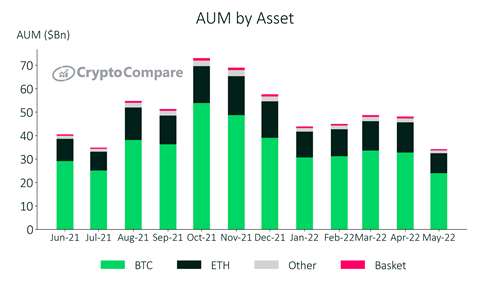

- Crypto Investment Products’ AUM Declined 28% in May