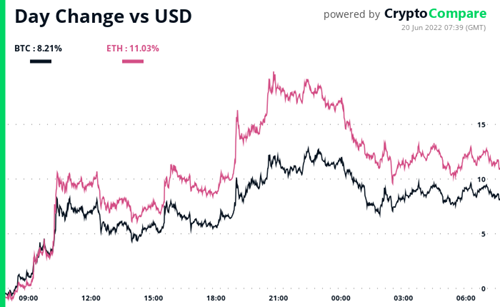

Bitcoin has bounced back from a 12-day decline after hitting a $17,600 low and is now trading close to the $20,000 mark as it leads a swift turnaround in the cryptocurrency market. The cryptocurrency is up 8.2% in the last 24 hours.

Sam Bankman-Fried’s Alameda Research has stepped in to prevent further contagion in the cryptocurrency space during the ongoing bear market, at a time in which numerous crypto companies face liquidity issues as a result of the collapse of UST and other macroeconomic factors.

Celsius Network’s lead investors, BnkToTheFuture, and its co-founder, Simon Dixon, have offered to assist the platform through a financial recovery plan similar to the one used by cryptocurrency exchange Bitfinex after its Bitcoin hack back in August 2016.

Top stories in the Crypto Roundup today:

- Bitcoin Bounces Back to $20,000 After 12-Day Slide

- Alameda Steps in to ‘Stem Contagion’ Amid Crypto Collapse

- Lead Celsius Network Investor Proposes Recovery Plan

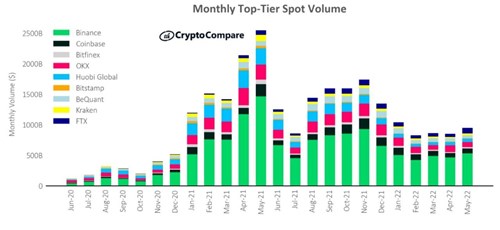

- FTX Overtakes Coinbase, OKX in Spot Trading Volume in May 2022