Eight months after the launch of the first U.S. bitcoin futures exchange-traded fund (ETF), ProShares is launching the first short bitcoin-linked ETF, the ProShares Short Bitcoin Strategy, which will trade on the New York Stock Exchange under the ticker BITI.

The U.K. government is not going to be implementing a proposed version of a controversial rule that would require those sending funds to private cryptocurrency wallets to collect the identification details of recipients.

Hong Kong-based cryptocurrency lender, Babel Finance, has reached “preliminary agreements on the repayment period of some debts” with counterparties as it improves its liquidity situation after abruptly limiting withdrawals last week.

Top stories in the Crypto Roundup today:

- ProShares Launches Short Bitcoin ETF

- UK Government Backtracks on Controversial Crypto Data Collection

- Crypto Lender Babel Finance Reaches Debt Repayment Agreements

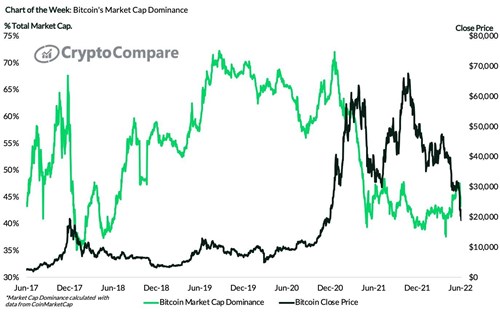

- Chart of the Week: Bitcoin’s Market Cap Dominance