Investors have allocated over $11 million into a recently launched bitcoin exchange-traded fund (ETF) designed to profit when the price of the flagship cryptocurrency declines. The ETF is now the second-largest bitcoin-focused ETF in the U.S.

Goldman Sachs is reportedly looking to raise $2 billion from investors to buy up the assets of embattled cryptocurrency lender Celsius. The deal would allow investors to buy the lender’s assets at potentially big discounts in the event of a bankruptcy filing.

Bitcoin miners are finding it difficult to repay as much as $4 billion in loans backed by their equipment amid BTC’s price decline. Analysts say an increasing number of loans are underwater, as some of the mining equipment accepted as collateral halved in value.

Top stories in the Crypto Roundup today:

- Short Bitcoin ETF Rakes In $11 Million as Investors Bet Against BTC

- Goldman Sachs Said to Be Raising $2 Billion to Buy Celsius’ Assets

- Nearly $4 Billion in Bitcoin Miner Loans are Under Stress

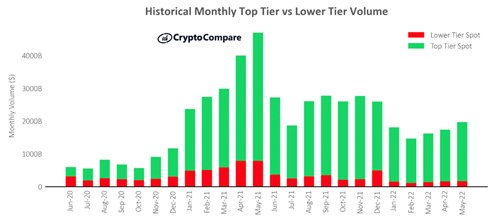

- Top-Tier Exchanges’ Market Share Rose to 91.5% of Total Spot Volume in May