Prominent cryptocurrency hedge fund Three Arrows Capital has defaulted on a $670 million loan from digital asset brokerage Voyager Digital, which issued a notice stating the fund failed to repay a $350 million USDC and 15,250 BTC loan.

Sam Bankman-Fried’s cryptocurrency exchange FTX is said to be exploring whether it may be able to acquire Robinhood Markets, the app-based commission-free brokerage. Robinhood hasn’t received a formal takeover approach.

Physical futures cryptocurrency exchange CoinFLEX is set to issue a Recovery Value USD (rvUSD) token after halting withdrawals on its platform over the outstanding debt a high-net-worth customer owes the platform.

Top stories in the Crypto Roundup today:

- Crypto Hedge Fund Three Arrows Capital Defaults on $670 Million Loan

- FTX Said to Be Eyeing Robinhood Acquisition

- Crypto Exchange CoinFLEX to Issue Tokens After Freezing Withdrawals

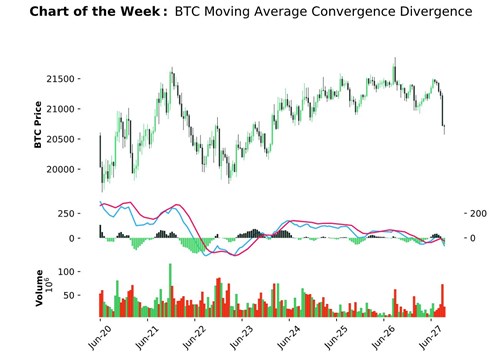

- Chart of the Week: BTC Moving Average Convergence Divergence