Russia is reportedly considering accepting Bitcoin as a payment method for its oil and gas exports, according to the chair of Russia’s Duma committee on energy, Pavel Zavalny, who said “friendly” countries could be allowed to pay in the cryptocurrency or their local currencies.

Oil giant ExxonMobil (XOM) is running a pilot project to use excess natural gas that would otherwise be burned off from North Dakota oil wells to power cryptocurrency mining operations.

A survey from investment banking giant Goldman Sachs shows investors are still bullish on cryptocurrencies. The bank reportedly surveyed 172 clients on their attitudes toward digital assets, and 60% revealed they expect to increase crypto holdings in the next one to two years.

Sponsored: The Invictus suite of funds offered commendable performance in a quarter marked by heightened volatility in the Bitcoin and broader cryptoasset market. All five of the Invictus funds registered positive returns for the quarter, with the vast majority outperforming their benchmarks.

Top stories in the Crypto Roundup today:

- Russia Considers Taking Bitcoin Payments for Oil and Gas

- ExxonMobil Runs Gas-to-Bitcoin Pilot Project

- 60% of Goldman Sachs Clients Ready to Increase Crypto Holdings

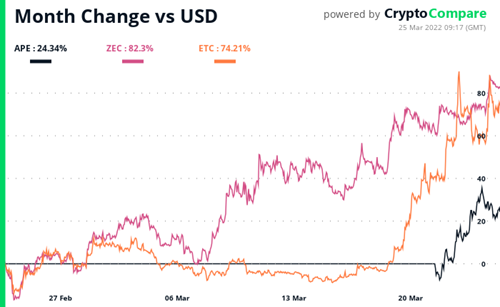

- Crypto Market Movers – APE, ZEC, ETC

- Sponsored: Invictus Capital continues to deliver an uninterrupted path of growth across all its funds