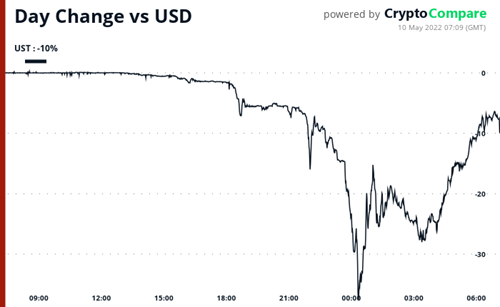

The Luna Foundation Guard, the custodian of Terra’s Bitcoin reserves, has deployed 28,205 BTC to defend the peg of the protocol’s UST stablecoin, which saw its value plunge to a $0.61 low amid ongoing market turmoil.

The U.S. Federal Reserve has published a new report on financial stability in which it emphasized stablecoins alongside certain money market funds and bonds as areas of risk in the current financial system.

El Salvadorian President Nayib Bukele has announced via social media the country “bought the dip” and acquired 500 BTC at an average price of $30,744.

Sponsored: In 2017, Invictus set out to fundamentally change the asset management industry. Invictus' officially regulated funds are now institutional grade products with industry leading fees and very accessible minimum requirements.

Top stories in the Crypto Roundup today:

- Luna Foundation Guard Deploys 28,205 Bitcoin to Defend UST Peg

- Stablecoins are ‘Prone to Runs’, Says Federal Reserve

- El Salvador Announces 500 BTC Purchase

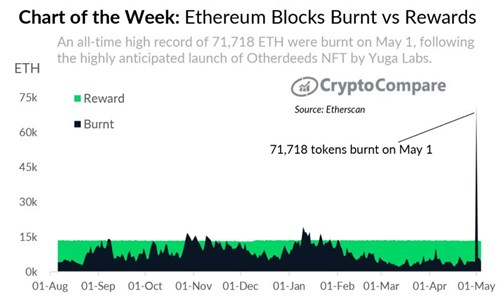

- Chart of the Week: Ethereum Blocks Burnt vs Rewards

- Sponsored: Invictus Capital spearheads the world's first regulated and tokenised mutual fund