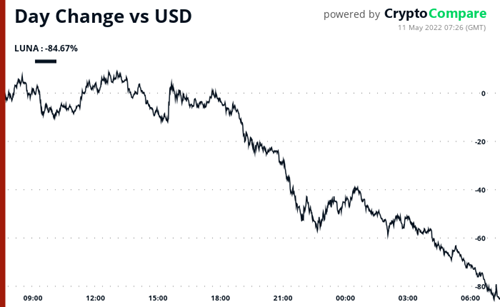

Terra’s native LUNA token has now lost 85% of its value and is trading below the $5 mark amid an ongoing collapse of its algorithmic stablecoin UST, which saw its value drop below $0.35 following a short rally.

Cryptocurrency markets declined in April, with Bitcoin and Ethereum closing the month down 17.3% and 16.9% respectively. These drops are a result of continued macroeconomic uncertainty following the war in eastern Europe and accelerating inflation figures throughout the world.

Coinbase has reported first-quarter results that missed analysts’ revenue estimates after the bell. The cryptocurrency exchanges revenue dropped to $1.17 billion, compared to analysts’ average estimate of $1.5 billion.

Sponsored: Binance has launched a special promotion for new Binance Card users!

Top stories in the Crypto Roundup today:

- Terra’s LUNA Plunges 85% as UST Stablecoin Collapses

- Bitcoin Spot Trading into USD Dropped 26% in April

- Coinbase Misses Q1 Revenue Estimates

- Sponsored: Get 5 BUSD & Stand a Chance to Win 1 Bitcoin in Token Voucher with Binance Card!