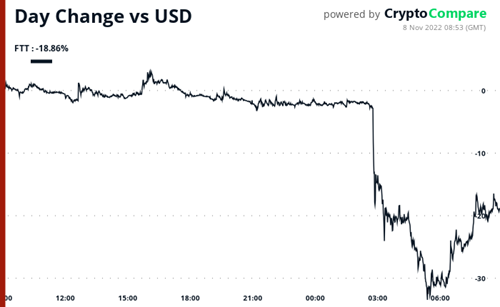

The price of FTX’s FTT token has lost around 18% of its value over the past 24-hour period as the cryptocurrency market fears the exchange’s quant trading firm Alameda Research could be insolvent.

The U.S. Department of Justice has announced it seized around $3.36 billion worth of stolen Bitcoin during a previously unannounced raid on the residence of James Zhong. The announcement came after Zhong pleaded guilty to one count of wire fraud.

A New Hampshire judge has ruled that cryptocurrency startup LBRY violated securities laws by selling its native LBC tokens without registering with the U.S. Securities and Exchange Commission (SEC).

Top stories in the Crypto Roundup today:

- FTX’s FTT Token Plummets as Market Weighs Contagion Fears

- DOJ Seizes $3.36 Billion in Bitcoin Stolen From Silk Road Marketplace

- Federal Judge Rules LBRY Sold Tokens as Securities

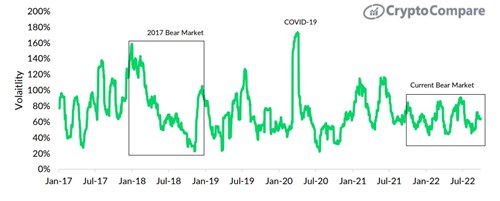

- Bitcoin Volatility Across Bear Markets