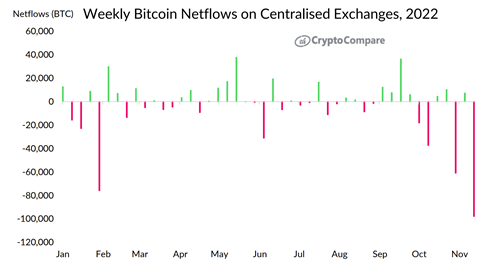

Weekly Bitcoin net flows from centralized exchanges recorded their largest outflow, with 97,805 BTC moving off of trading platforms in the 7-day period ending on November 13.

Embattled cryptocurrency exchange FTX has said it owes almost $3.1 billion to its 50 largest creditors, and around $1.45 billion to its top 10 creditors, without naming any. The exchange filed for bankruptcy in the US earlier this month.

The entity behind the $600 million exploit of FTX has started exchanging millions of dollars worth of Ether to Ren Bitcoin (renBTC), a tokenized version of Bitcoin on other blockchains. The move comes after funds stolen from FTX were steadily converted into ETH.

Cryptocurrency investment firm Grayscale has refused to share proof of reserves after its Bitcoin and Ether products fell to new all-time lows citing security concerns.

Top stories in the Crypto Roundup today:

- Centralized Exchanges Record Largest Ever Weekly BTC Outflows

- FTX Owes Largest Creditors $3.1 Billion

- FTX Exploiter Converts ETH to Alameda-Linked renBTC

- Grayscale Refuses to Share Proof of Reserves Over Security Concerns