Binance is aiming for its crypto industry recovery fund to be at least $1 billion. The fund would be used for the potential purchase of distressed assets in the industry, according to its CEO Changpeng Zhao.

The Bank of Japan (BoJ) is set to test its central bank digital currency (CBDC) in a collaboration with three megabanks and regional banks. The pilot will start in the spring of 2023, and will see the Bank of Japan work with private banks to identify any problems with deposits and withdrawals.

Ethereum software firm ConsenSys, the firm behind the popular MetaMask wallet, has said it collects user data related to the on-chain wallet service. The revelation comes days after decentralized exchange (DEX) Uniswap made a similar update to its privacy policy.

Top stories in the Crypto Roundup today:

- Binance Aims for $1 Billion Crypto Recovery Fund

- Bank of Japan to Test Digital Yen With Country’s Megabanks

- MetaMask Creator ConsenSys Reveals It Collects User Data

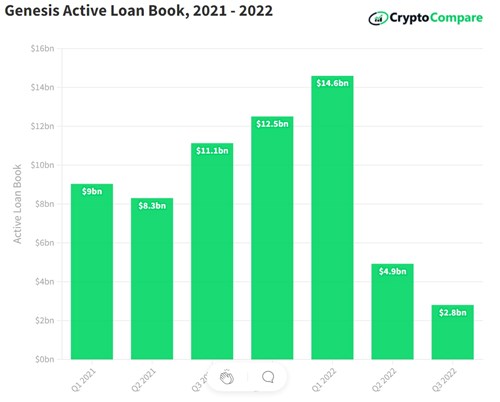

- Genesis’ Role in the Market