The Financial Stability Oversight Council’s first major report on cryptocurrencies has warned that cryptocurrency markets need more oversight, as the widespread adoption of digital assets poses risks if the market grows without it.

Decentralized cryptocurrency exchanges have been growing faster than centralized exchanges over the past two years, according to a research report published by Citigroup.

Leading stablecoin issuer Tether has nearly slashed all of its commercial paper holdings, and now has less than $50 million worth of the short-term, unsecured debt instrument.

Sponsored: Acquire.Fi has launched its native token ($ACQ) on the 28th of September 2022. Trading was scheduled to go live on the KuCoin centralized exchange at 15:00 pm UTC, with KuCoin adding support to the ACQ/USDC trading pair. Five minutes later, the token was listed on the Uniswap decentralized exchange.

Top stories in the Crypto Roundup today:

- Crypto Market Needs Better Oversight, US Risk Watchdog Warns

- Decentralized Exchanges Are Gaining Market Share: Citi

- Tether’s Commercial Paper Exposure Drops Below $50 Million

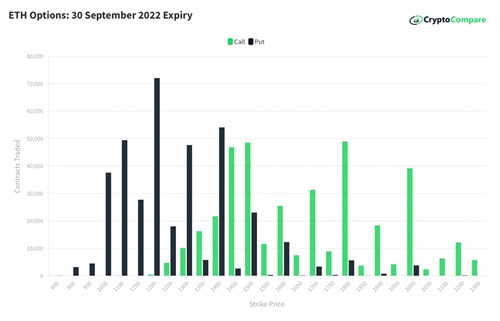

- 95.9% of Ethereum Call Options Expired Worthless in September

- Sponsored: Announcing the Acquire.Fi (ACQ) Token and Closed Platform Beta Launch!