The BNB Chain, the blockchain of Binance’s native BNB token, has been halted over an exploit to its cross-chain bridge that saw attackers make off with an estimated $100 million worth of cryptocurrency.

Leading liquid staking decentralized finance (DeFi) platform Lido has announced that it will support the wrapped version of its token representing staked ether (stETH) on Ethereum layer-2 networks Arbitrum and Optimism.

The decentralized autonomous organization behind Maker, the organization that supports the cryptocurrency-backed stablecoin DAI, is allocating $500 million to invest in U.S. Treasuries and corporate bonds.

Top stories in the Crypto Roundup today:

- BNB Chain Halted Over $100 Million Cross-Chain Bridge Exploit

- Lido Launches Layer-2 Ethereum Liquid Staking

- MakerDAO to Invest $500 Million in Treasuries, Bonds

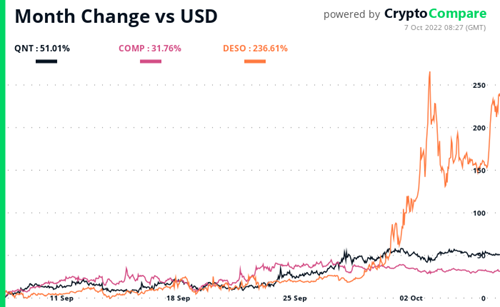

- Crypto Market Movers – QNT, COMP, DESO