The MakerDAO community has approved a proposal to custody up to $1.6 billion in USDC on the Coinbase Prime platform. The proposal was submitted by Coinbase and will allow MakerDAO to earn a 1.5% reward on its USDC.

NEAR Protocol’s USN stablecoin is being phased out after it started showing characteristics observed in TerraUSD, the algorithmic stablecoin that collapsed earlier this year. The stablecoin, issued by the DAO Decentral Bank, recently became uncollateralized.

Apple has updated its App Store policy to restrict apps from using non-fungible tokens (NFTs) to incentivize users to purchase items or features the tech giant isn’t able to tax. The company charges up to 30% on all purchases made on its App Store and money spent when using apps.

Top stories in the Crypto Roundup today:

- MakerDAO Approves USDC Institutional Rewards Program With Coinbase

- NEAR Protocol to Wind Down Undercollateralized Stablecoin

- Apple Starts Restricting Apps From Using NFTs to Avoid App Store Fees

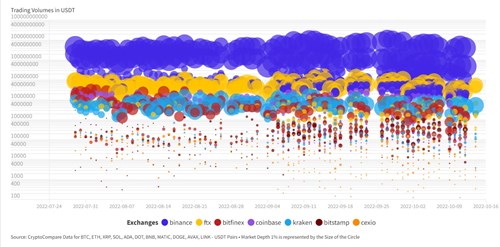

- Chart of the Week: Volumes and 1% Market Depth for AA&A Tier Exchanges