Analysts at global audit and consulting firm KPMG have predicted that even as investments in cryptocurrencies and blockchain technologies keep on declining, they do not yet see a bottom and expect the slowdown to continue.

Russia is reportedly in talks with several friendly countries about launching clearing platforms for cross-border settlements using stablecoins.

Decentralized finance (DeFi) protocol Aave has invoked new rules to protect itself from risks that could stem from a surge in borrowing demand for Ethereum (ETH) ahead of the network’s Merge upgrade.

Top stories in the Crypto Roundup today:

- KPMG Predicts Crypto Slowdown Will Continue

- Russia Exploring Cross-Border Stablecoin Settlements

- DeFi Giant Aave Halts Ether Loans Ahead of the Merge

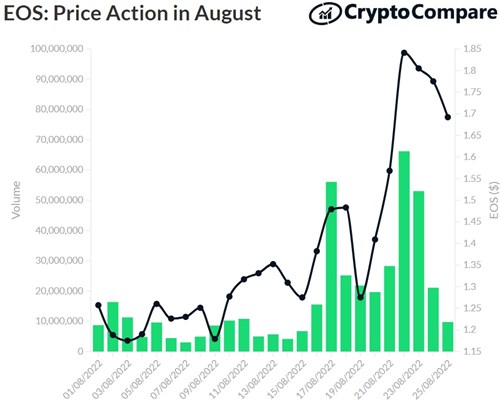

- EOS’ Price Action Ahead of the Hard Fork