Nasdaq-listed business intelligence firm MicroStrategy, known as the largest corporate buyer of Bitcoin, has filed with the U.S. Securities and Exchange Commission (SEC) to sell as much as $500 million in stock to fund additional BTC purchases.

Banking giant State Street has said that institutional investors are unfazed by the cryptocurrency winter and have maintained their interest in blockchain technology and digital assets despite the market slump.

Google has created a “doodle” that is counting down to Ethereum’s upcoming Merge upgrade as a sign of recognition of the cryptocurrency’s network.

Top stories in the Crypto Roundup today:

- MicroStrategy to Sell Stock to Fund Bitcoin Purchases

- Institutional Investors Undeterred by Crypto Winter: State Street

- Google ‘Doodle’ Counts Down to Ethereum Merge

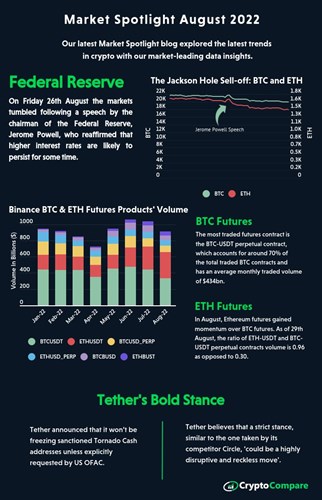

- Market Spotlight: August 2022