Financial services giant Fidelity is contemplating whether to let individual brokerage customers trade Bitcoin (BTC). The move follows a BlackRock partnership with Coinbase to offer crypto trading to institutional customers.

The team behind EthereumPoW (ETHPOW), a Proof-of-Work network that could be created through a fork of the Ethereum network at the time of the Merge upgrade, has announced its plans to launch its separate chain.

Popular cryptocurrency trading platform Huobi is set to delist seven different privacy-centric cryptocurrencies from its platform over regulatory pressure associated with anonymity-enhanced currencies (AECs).

Top stories in the Crypto Roundup today:

- Fidelity Considers Offering Crypto Trading to Brokerage Clients

- Ethereum Fork ETHPOW Announces Post-Merge Plans

- Huobi to Delist Monero and Other Privacy Coins

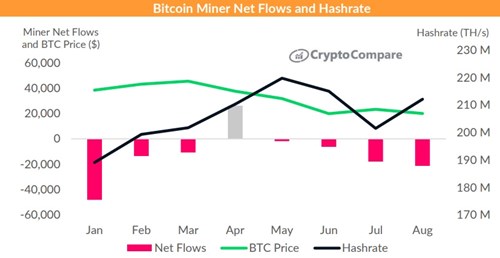

- Bitcoin Miners’ Net Flows