In the first hours after Ethereum’s long-awaited Merge was completed, over 40% of the network’s blocks were added by two entities: Coinbase and Lido. The move to Proof-of-Stake was partly framed as a way to defeat centralization on the network.

SEC Chairman Gary Gensler has said that Proof-of-Stake cryptocurrencies, which allow holders to passively earn returns while securing the network through staking, could be securities. This would mean cryptocurrencies like Solana, Cardano, and Ethereum could be included.

Analysts at JPMorgan Chase have said that Binance’srecent decision to convert existing balance and new deposits of USDC, USDP, and TUSD into its own stablecoin, BUSD, will benefit Tether.

Top stories in the Crypto Roundup today:

- Ethereum Centralization Concerns Grow Post-Merge

- SEC Chairman Says Proof-of-Stake Assets Could be Securities

- Binance’s Stablecoin Move Could bolster Tether’s Importance: JPMorgan

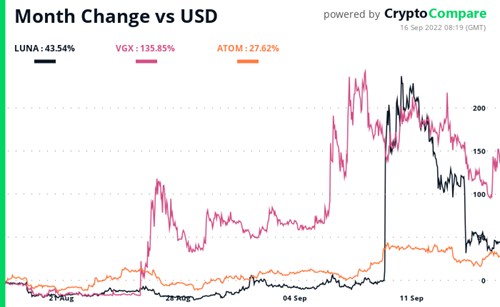

- Crypto Market Movers – LUNA. VGX, ATOM