A new anti-money laundering bill introduced in the UK is set to make it easier for law enforcement to seize, freeze, and recover digital assets as part of a broader crackdown on money laundering.

Cardano’s long-awaited Vasil hard fork has gone live on the network, bringing “significant performance and capability” enhancements to the cryptocurrency’s blockchain.

Nasdaq-listed cryptocurrency exchange Coinbase has denied it engages in proprietary trading or acts as a market maker, while implying that “many” of its competitors do. Per the firm, one of the competitive strengths of its Institutional Prime platform is that it only acts on behalf of clients.

Top stories in the Crypto Roundup today:

- New UK Law Makes it Easier for Authorities to Seize, Freeze Crypto

- Cardano’s Vasil Hard Fork Goes Live

- Coinbase Rejects Proprietary Trading Allegations

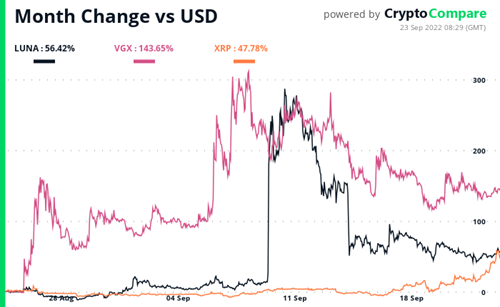

- Crypto Market Movers – LUNA, VGX, XRP