The European Central Bank (ECB) has revealed that it is analyzing options to integrate decentralized ledger technology (DLT) into existing payment settlement systems during a speech from Fabio Panetta, an ECB executive board member.

Cryptocurrency exchange FTX has won the bidding war to buy the assets of bankrupt Voyager Digital. The agreement, valued at about $1.4 billion, comprises an ”additional consideration” worth about $111 and the $1.3 billion market value of all cryptoassets on the platform.

State securities regulators in eight U.S. states took action against Nexo Group, the parent company of cryptocurrency lender Nexo, calling the company’s Earn Interest Product an unregistered security.

Top stories in the Crypto Roundup today:

- ECB Wants to Prepare for Broad Crypto Adoption ‘Scenario’

- FTX Wins Bid to Buy Bankrupt Firm Voyager’s Assets

- Crypto Lender Nexo Hit with Enforcement Actions in Eight U.S. States

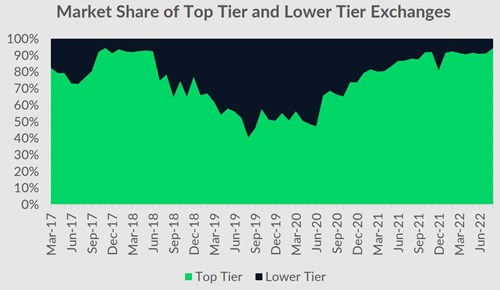

- Top-Tier Exchanges’ Market Share Keeps Rising