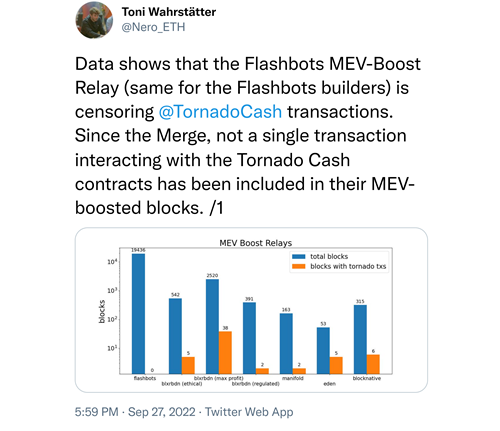

Ethereum researcher Toni Wahrstätter has found that at least 23% of Ethereum blocks are complying with U.S. sanctions due to the use of a service called Flashbots. His research has shown that maximum extractable value (MEV) operator Flashbots is censoring all transactions originating from Tornado Cash.

Smart contract oracle platform and SWIFT, the Society for Worldwide Interbank Financial Telecommunication are partnering to try to bridge the gap between traditional banks and blockchains.

Circle, the company behind the world’s second-largest stablecoin, USDC, has announced it will soon be making the cryptocurrency available on five additional blockchains: Arbitrum, Cosmos, NEAR, Optimism, and Polkadot.

CryptoCompare, the global leader in digital asset data and FCA-authorised benchmark administrator, and Blockdaemon, the leading institutional-grade blockchain infrastructure company for node management and staking, have announced the launch of their industry-first family of Staking Yield Indices.

Sponsored: Acquire.Fi is launching its native token ($ACQ) on the 28th of September 2022. Trading is scheduled to go live on the KuCoin centralized exchange at 15:00 pm UTC, with KuCoin adding support to the ACQ/USDC trading pair.

Top stories in the Crypto Roundup today:

- 23% of Ethereum Blocks are Complying With US Sanctions

- SWIFT Partners With Chainlink to Bridge Traditional Finance and Blockchain

- Circle’s USDC Stablecoin Expands to Five New Blockchains

- CryptoCompare and Blockdaemon Launch Industry-First Staking Yield Indices