El Salvador’s inaugural digital asset service Provider license has been granted to popular cryptocurrency exchange Bitfinex.

The web3 investment arm of Andreessen Horowitz, a16z Crypto, has released a new “State of Crypto” index, which offers an optimistic overview of the emergent asset class.

Montenegro’s Central Bank has announced a collaboration with fintech company Ripple to explore the feasibility of creating a digital currency for the nation. Montenegro has used the euro as its currency since its introduction in 2022, even though it’s not a part of the Eurozone.

Top stories in the Crypto Roundup today:

- Bitfinex Secures El Salvador's First Digital Asset Service Provider License

- a16z Launches "State of Crypto" Index

- Montenegro Teams Up with Ripple to Explore National Digital Currency

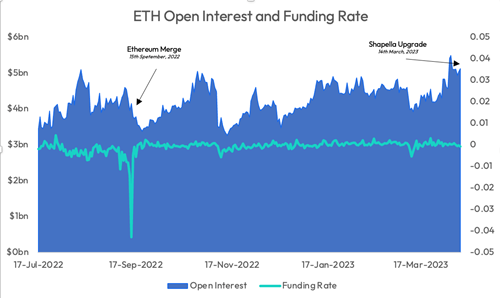

- Ethereum Outlook Ahead of Shapella Upgrade