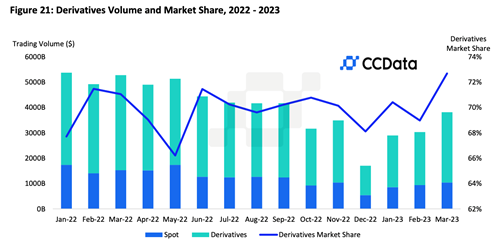

The trading volumes of cryptocurrency derivatives have experienced a three-month growth streak for the first time since January 2022. These products include financial contracts like futures and options related to digital currencies.

The U.S. House Financial Services Committee is making renewed efforts to establish a regulatory framework for stablecoins, such as USDC and Tether. The efforts come after the collapse of FTX last year, with negotiations between political parties and the Biden administration having stalled prior to the midterm elections.

Data from Russian cybersecurity and antivirus provider Kaspersky has revealed that there was a 40% year-on-year spike in cryptocurrency phishing attacks in 2022. The number of detected crypto phishing attacks rose dramatically from 3,596,437 in 2021 to 5,040,520 in 2022.

Top stories in the Crypto Roundup today:

- Crypto Derivatives Trading Volume Rises for Third Consecutive Month

- New Bill Seeks to Regulate Stablecoins, Ban Unbacked Tokens

- Crypto Phishing Attacks Surged 40% in 2022

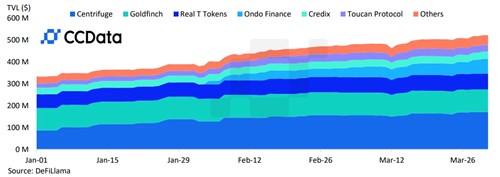

- DeFi’s Real World Assets Sector Keeps Growing