The European Parliament has endorsed the world's first legislative framework intended to govern the burgeoning cryptocurrency sector. The legislative body has voted 517 to 38 in favour of the Markets in Crypto Act (MiCA), marking a significant milestone in the global regulation of digital assets.

Societe Generale's cryptocurrency division, SG Forge, has announced the launch of a stablecoin pegged to the euro (EUR) on the Ethereum blockchain, marking the first asset of its kind on a public platform.

One of the three major credit reporting agencies in the United States, TransUnion, has announced plans to start supplying credit scoring to public blockchain networks, bringing off-chain credit data to the world of decentralized finance.

Top stories in the Crypto Roundup today:

- EU Parliament Passes Groundbreaking MiCA Crypto Regulation

- Societe Generale’s Crypto Arm Launches Euro-Pegged Stablecoin on Ethereum

- TransUnion to Offer Credit Scoring on Public Blockchains

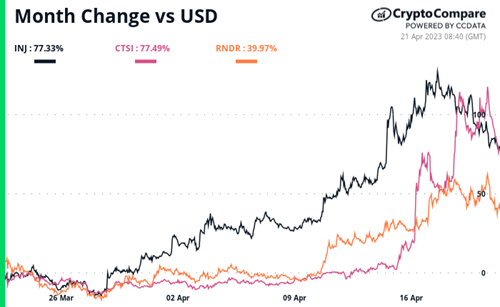

- Crypto Market Movers – INJ, RNDR, CTSI