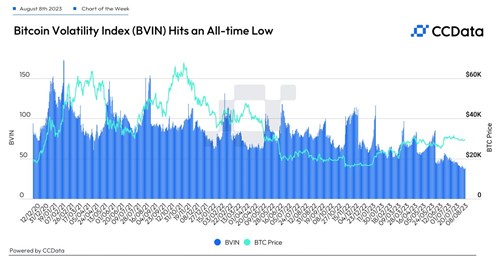

The Bitcoin Volatility Index (BVIN) plummeted to a record low of 36.3, reflecting the cryptocurrency's dwindling volatility, as determined by Deribit’s options contracts.

Meanwhile, the crypto world buzzes with anticipation as Galaxy Digital's CEO, Mike Novogratz, hinted at a potential approval of a spot Bitcoin ETF within half a year, citing sources from BlackRock and Invesco.

Adding to the mix, Bitstamp, a premier cryptocurrency exchange from Luxembourg, has declared its intention to halt trading of seven cryptocurrencies, including Solana and Sandbox, for its U.S. clientele starting August 29.

In other news, as Coinbase gears up for the grand unveiling of its layer-2 solution, Base, it has welcomed Chainlink, the leading decentralized oracle network, as a new partner to further support decentralized applications.

Top stories in the Crypto Roundup today:

- Galaxy Digital CEO: Spot Bitcoin ETF Could Arrive in Six Months

- Bitstamp Drops Trading of Seven Crypto Tokens for US Users

- Coinbase’s Layer-2 Network Base Integrates Chainlink Price Feeds

- Chart of the Week: Bitcoin Volatility Index Hits All-Time Low