BlackRock has updated its application for a spot Bitcoin exchange-traded fund (ETF) to make it more accessible for major Wall Street banks by allowing banks to create new shares in the fund using cash, instead of relying solely on cryptocurrency.

S&P Global has unveiled a new stablecoin stability assessment used to rate eight leading stablecoins. None of the rated stablecoins achieved the highest rating, while two were marked with the lowest rating.

Coinbase Asset Management is launching a new service called Project Diamond, designed for institutional investors to issue and trade digital debt instruments seamlessly using Base, Conbase’s Ethereum layer-2 network.

Top stories in the Crypto Roundup today:

- BlackRock’s Proposed Bitcoin ETF Revised for Bank Participation

- S&P Global Launches Stablecoin Ratings, None Get Top Score

- Coinbase Launches Project Diamond, a Blockchain-Based Debt Platform for Institutions

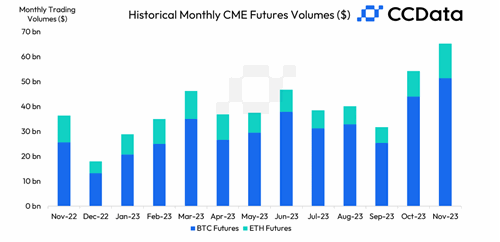

- CME Overtakes Binance for BTC Futures Open Interest