The U.S. Securities and Exchange Commission (SEC) has extended its review period for several Ether exchange-traded funds (ETFs), setting a new decision deadline for May 2024.

A U.S. court has ordered cryptocurrency exchange Binance and its former CEO, Changpeng “CZ” Zhao, to pay substantial fines to the Commodity Futures Trading Commission (CFTC).

Prominent fintech firm Revolut is temporarily suspending some of its cryptocurrency services for business clients in the UK in response to upcoming regulatory changes announced by the Financial Conduct Authority (FCA).

Top stories in the Crypto Roundup today:

- SEC Postpones Decision on Ether ETFs Until May 2024

- Binance and Former CEO CZ to Pay $2.85 Billion in CFTC Settlement

- Revolut Suspends Crypto Services for UK Business Clients

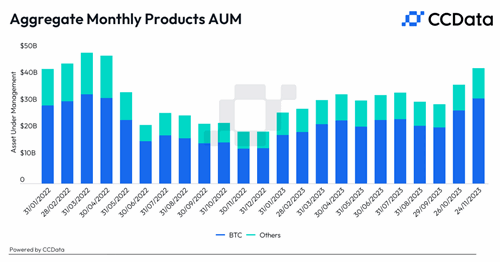

- Crypto Investment Products’ AUM Soar by Over 150% YTD