Ethereum’s developers are set to launch a new testnet called “Zhejiang,” allowing users to start testing Ethereum Improvement Proposal (EIP) 4895, which enables staked ether withdrawals, which will be included in the network’s next large upgrade, the Shanghai hard fork.

The UK Treasury released a consultation paper outlining plans to regulate cryptocurrency trading platforms and lenders. The paper is open for comment until April 30, and aims to give “confidence and clarity to consumers and businesses alike.”

According to a court filing by Kirkland & Ellis LLP on behalf of Celsius Network, some users of the bankrupt crypto lender's custody program will be able to retrieve 94% of their eligible assets.

Top stories in the Crypto Roundup today:

- Ethereum Developers to Trial New Staking Withdrawal Testnet

- UK Treasury Plans to Regulate Crypto Exchanges and Lenders

- Bankrupt Crypto Lender Celsius Says Some Users Can Withdraw Assets

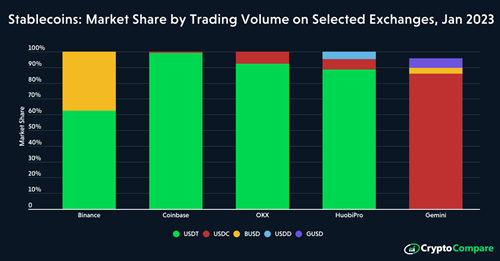

- Stablecoins Market Share on Different Exchanges