Leading cryptocurrency exchange Binance has announced the launch of a tax estimating tool that will help users stay on top of their cryptocurrency transactions for tax reporting purposes.

Potential buyers have been inquiring about purchasing embattled cryptocurrency lender Hodlnaut and its claims against the collapsed cryptocurrency exchange FTX. Various parties are reportedly interested in the acquisition.

Collapsed cryptocurrency exchange FTX is asking political figures and groups to return donations linked to the platform’s former CEO Sam Bankman-Fried, and other FTX executives by the end of the month.

Top stories in the Crypto Roundup today:

- Binance Launches Crypto Tax Estimator

- Potential Buyers Inquire About Purchasing Embattled Crypto Lender Hodlnaut

- FTX Debtors Move to See Political Donations Returned

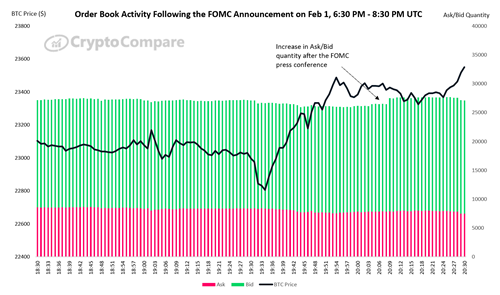

- Order Book Activity Following the FOMC’s February Rate Hike