Stablecoin issuer Paxos Trust has been told by the U.S. Securities and Exchange Commision (SEC) the regulator is planning to sue it for violating investor protection laws in a letter known as a Wells notice, which it uses to inform entities of possible enforcement action.

Fintech giant PayPal has paused the development of its stablecoin after its cryptocurrency partner, Paxos, was reported to be under investigation by the New York Department of Financial Services.

The International Monetary Fund (IMF) has said that the risks of El Salvador’s Bitcoin adoption “have not materialized” over the country’s “limited” use.

Top stories in the Crypto Roundup today:

- Paxos Faces SEC Lawsuit Over Binance USD: WSJ

- PayPal Pauses Stablecoin Project Amid Paxos Probe

- IMF Says El Salvador’s Bitcoin Risks Did Not Materialize

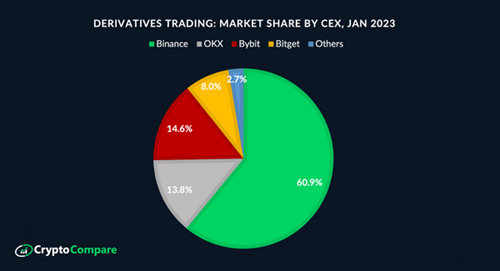

- Derivatives Trading Market Share by CEX