The number of Ordinal inscriptions on the Bitcoin (BTC) network has surpassed 100,000, a milestone that comes less than a day after Ordinals crossed the 75,000 inscription mark. Transaction fees for these NFTs have topped $114,000.

The amount of Bitcoin traded on the DBS Digital Exchange surged 80% last year, while the number of BTC in custody as of December 31 more than doubled from a year earlier, despite the cryptocurrency bear market.

Stablecoin issuer Circle has denied rumors it received a Wells notice from the U.S. Securities and Exchange Commission (SEC) over USDC. Dante Disparte, Chief Strategy Officer and Head of Global Policy at Circle Pay, denied the rumors on social media.

Top stories in the Crypto Roundup today:

- Bitcoin NFTs Surpass 100,000 Inscription Mark

- DBS Exchange Says Bitcoin Trading Surged 80% During Crypto Winter

- Circle Denies Rumors it Received a Wells Notice

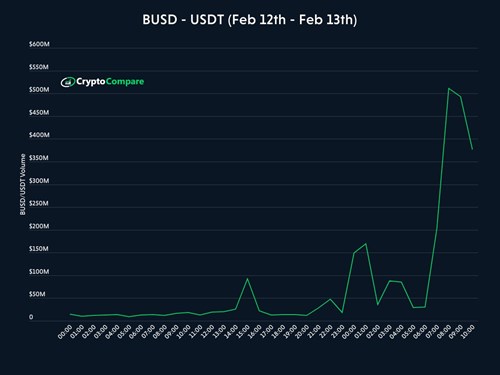

- BUSD-USDT Trading Volume Surges 4,600%