The U.S. Securities and Exchange Commission (SEC) has proposed toughening cryptocurrency custody rules after the collapse of several high-profile crypto firms revealed users’ funds weren’t as safe as advertised.

The European Central Bank (ECB) has advised banks in the European Union to start applying caps on Bitcoin holdings ahead of global standards established by the Basel Committee on Banking Supervision (BCBS).

Interactive Brokers (IBKR) has started offering professional investors in Hong Kong cryptocurrency trading services, through a partnership with digital asset exchange OSL Digital Securities.

Top stories in the Crypto Roundup today:

- SEC Pushes For Tougher Crypto Custody Rules

- ECB Advises Banks to Apply Caps on Crypto holdings

- Interactive Brokers Launches Crypto Trading for Professional Investors in Hong Kong

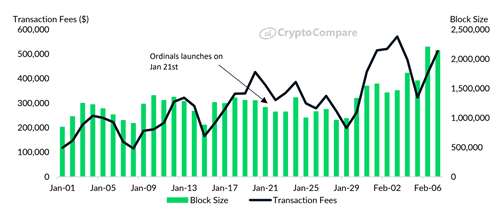

- Bitcoin Block Size Hits New All-Time High