The Solana network was affected by an hours-long network slowdown over the weekend that saw the developers who help operate it try to restart the network, in what is the latest in a series of technical issues that have plagued Solana since its launch.

Liquid staking protocol Lido Finance said over the weekend it saw the largest daily stake inflow ever, with over 150,000 ether worth almost $240 million being staked in a single day.

Ukraine has received over $70 million in cryptocurrencies since the start of the Russian-Ukrainian conflict, with most of the funds coming in the form of either Bitcoin or Ether.

Top stories in the Crypto Roundup today:

- Solana Affected by Hours-Long Network Slowdown

- Lido Finance Reports Record 150,000 ETH Staked in a Day

- Ukraine Received Over $70 Million in Crypto Since Start of Russia Conflict

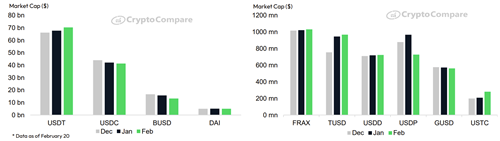

- USDT and TUSD Benefit from BUSD’s Decline