The U.S. Securities and Exchange Commission (SEC) has filed a lawsuit against Gemini and Genesis for allegedly failing to properly register their cryptocurrency lending program, Earn, as a securities offering.

Additionally, Bulgarian prosecutors have launched an investigation into alleged illegal activities by cryptocurrency lender, Nexo, resulting in the raid of over 15 sites in the capital city of Sofia.

On the technical front, Polygon Labs has announced plans to proceed with a hard fork for the Polygon network in the upcoming week. The hard fork aims to mitigate network gas fee spikes and tackle chain reorganization issues.

Top stories in the Crypto Roundup today:

- SEC Sues Gemini and Genesis Over Crypto Lending Program

- Bulgaria Raids Crypto Lender Nexo Amid Ongoing Probe

- Polygon to Undergo Hard Fork

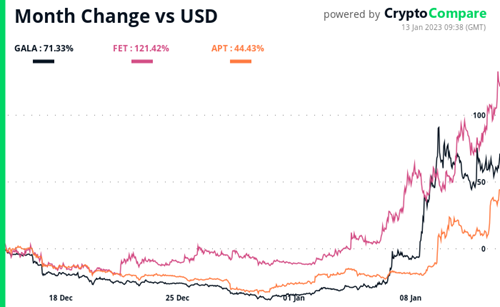

- Crypto Market Movers – GALA, FET, APT