FTX’s new chief executive officer, John J. Ray III, has said he established a task force to explore restarting FTX.com, the company’s main international exchange, as he works to return money to the failed company’s customers and creditors.

Cryptocurrency lender Genesis, which is part of cryptocurrency conglomerate Digital Currency Group, has filed for Chapter 11 bankruptcy protection in a Manhattan federal court. The firm listed over 100,000 creditors and aggregate liabilities ranging from $1.2 billion to $11 billion.

Cryptocurrency lender Nexo has agreed to pay $45 million in penalties to the U.S. Securities and Exchange Commission (SEC) and the North American Securities Administrators Association (NASAA) after failing to register the offer and sale of its Earn Interest Product.

Top stories in the Crypto Roundup today:

- New FTX CEO Explores Restarting Exchange

- Genesis’ Lending Businesses File for Bankruptcy

- Crypto Lender Nexo Agrees to Pay $45 Million in Penalties to SEC

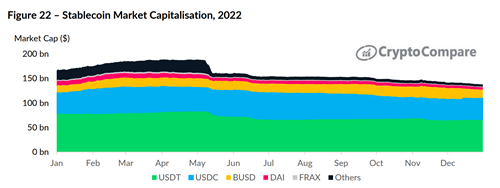

- Stablecoin Market Cap Dominance Rises