Leading cryptocurrency exchange Binance has revealed that Signature Bank won’t handle user transactions below $100,000 for its customers as it reduces its exposure to cryptocurrency markets.

Federal prosecutors have seized nearly $700 million in cash and assets connected to former FTX CEO Sam Bankman-Fried, primarily in the form of Robinhood shares that he owned.

Cryptocurrency revenue extorted by ransomware attackers has plunged last year as victims have started refusing to pay ransoms to the attackers. Many cryptocurrency addresses controlled by attackers are, however, yet to be identified.

Sponsored: Ledger Stax is the go-to digital asset management solution for individuals and businesses who demand the highest level of security and customization. Now available for pre-order, Ledger Stax sets itself apart with its innovative features and sleek design.

Top stories in the Crypto Roundup today:

- Binance SWIFT Partner to Ban Transfers Below $100,000

- Prosecutors Seize Nearly $700 Million in Assets Tied to SBF

- Ransomware Crypto Revenue Plunges as Victims Refuse to Pay

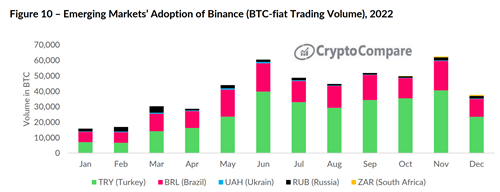

- Emerging Markets’ Digital Asset Usage Accelerates

- Sponsored: Experience Peace of Mind with Ledger Stax's Secure Digital Asset Management Platform