Bankrupt cryptocurrency lender BlockFi had over $1.2 billion in assets tied to Sam Bankman-Fried’s FTX and Alameda Research, according to financials that were recently uploaded without the redactions.

Crypto infrastructure company Blockstream has raised $125 million in convertible notes and secured loan financing to further its bitcoin mining hosting services. The company said it will use the funds to expand its mining facilities to meet the strong demand for large-scale hosting services.

Leading cryptocurrency exchange Binance has acknowledged that it mistakenly kept the collateral for some of its B-Tokens, which represent tokenized versions of various cryptocurrencies on the BNB Chain, in the same wallet as the exchange users’ funds.

Top stories in the Crypto Roundup today:

- BlockFi Financials Reveal $1.2 Billion FTX Exposure

- Crypto Infrastructure Firm Blockstream Secures $125M in Funding for Bitcoin Mining

- Binance Acknowledges Error in Mixing B-Tokens’ Collateral and Customer Funds

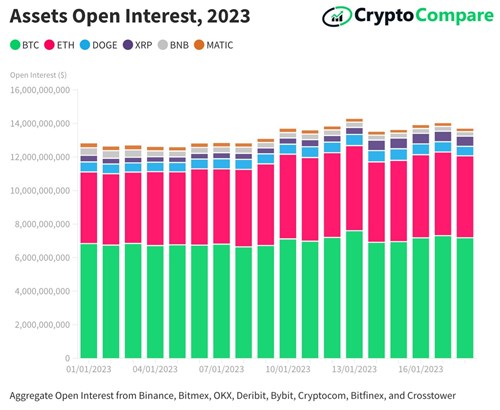

- Chart of the Week: Assets Open Interest in 2023