Credit-ratings giant Moody’s is working on a scoring system for stablecoins as the asset class keeps growing. The system will include an analysis of up to 20 stablecoins based on the quality of attestations on the reserves backing them.

FTX’s bankruptcy lawyers are seeking permission to subpoena the exchange’s former CEO, Sam Bankman-Fried, as well as his family and top lieutenants.

The U.S. Securities and Exchange Commission (SEC) has rejected a proposal to launch a Bitcoin spot exchange-traded fund (ETF) from Cathie Wood’s ARK Invest and global crypto ETF provider 21Shares.

Top stories in the Crypto Roundup today:

- Moody’s Working on Stablecoin Scoring System

- FTX Seeks Permission to Subpoena Former CEO Sam Bankman-Fried and Insiders

- SEC Rejects Spot Bitcoin ETF Bid from ARK and 21Shares

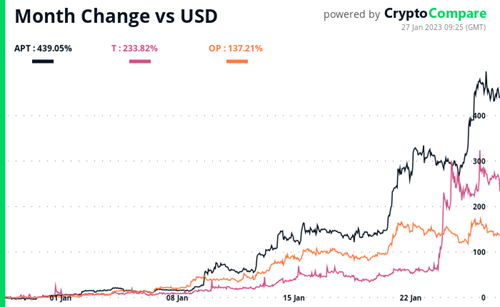

- Crypto Market Movers – APT, T, OP