Twitter has started seeking regulatory licenses in the US and is developing software to introduce payments on the platform. Twitter CEO Elon Musk has said the system will be first and foremost a fiat currency system, but it will include crypto functionality.

Digital asset manager Osprey Funds has filed a lawsuit against its rival Grayscale Investments in Connecticut Superior Court, accusing Grayscale of “false and misleading advertising” for its Grayscale Bitcoin Trust (GBTC) since late 2020.

Nasdaq-listed cryptocurrency exchange Coinbase has launched a set of new security features for its Coinbase Wallet product, ia self-custody solution allowing users to control their own private keys and interact with smart contracts on various networks.

Top stories in the Crypto Roundup today:

- Twitter Considering Adding Crypto Payments

- Osprey Funds Sues Grayscale Over GBTC Advertisement

- Coinbase Wallet Adds New Security Features

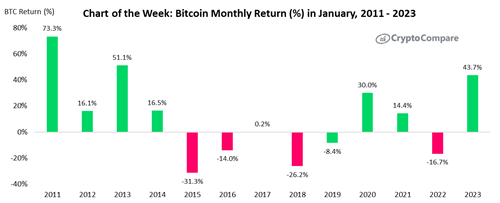

- Chart of the Week: Bitcoin’s Monthly Return in January