Cboe Global Markets has made significant amendments to five pending spot Bitcoin exchange-traded fund (ETF) applications to integrate surveillance-sharing agreements (SSAs) with Nasdaq-listed cryptocurrency exchange Coinbase.

Singapore’s sovereign wealth fund Temasek has revealed it’s avoiding investments in cryptocurrency-based firms in the midst of the regulatory turbulence surrounding the sector.

The Bank of International Settlements (BIS), a grouping of the world’s major central banks, has released a report to the finance ministers of G20 nations asserting that the "inherent structural flaws" of cryptocurrencies render them unfit to serve as a monetary tool.

Top stories in the Crypto Roundup today:

- Cboe Updates Five Bitcoin ETF Filings With Coinbase Surveillance Deal

- Temasek Shuns Crypto Investments Amid Regulatory Uncertainty

- BIS Slams Crypto Over ‘Inherent Structural Flaws’

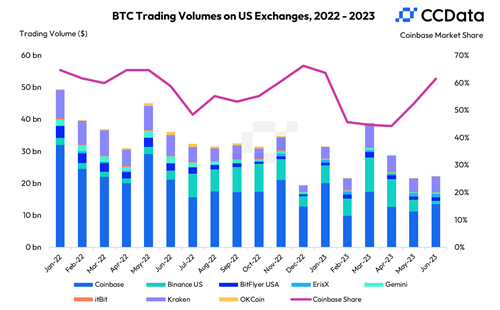

- Coinbase Commanded 61% of US Bitcoin Volumes in June