In a ruling that has set the cryptocurrency market abuzz, a federal judge in New York determined that the XRP token "is not necessarily a security on its face." The decision drew reassurance to the sector that altcoins may not be classified as securities.

In the aftermath of a multifaceted ruling by a U.S. federal judge regarding the ongoing legal battle between Ripple Labs and the SEC that deemed XRP is “not necessarily a security on its face,” a number of cryptocurrency exchanges started relisting the token.

Celsius, the now-bankrupt crypto lender, and its former CEO, Alex Mashinsky, are facing a slew of federal charges, stemming from multiple U.S. agencies including the Department of Justice (DOJ), Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), and Federal Trade Commission (FTC).

Top stories in the Crypto Roundup today:

- Judge Rules XRP Is ‘Not Necessarily a Security’ in Landmark Case

- Crypto Exchanges Relist XRP After Judge’s Ruling on SEC Case

- Celsius’s Former CEO Mashinsky Arrested for Fraud, SEC and CFTC Sue Crypto Lender

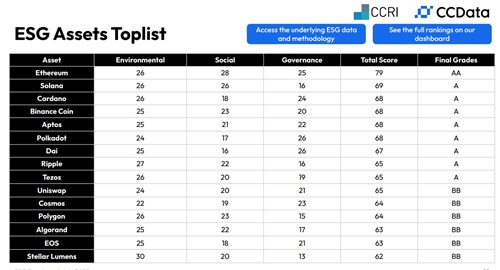

- Ethereum Tops CCData’s Crypto ESG Ranking