A key committee in the U.S. House of Representatives has given the green light to a bill that aims to provide clearer rules for the cryptocurrency industry. The Republican-led bill got through the House Financial Services Committee with a 35-15 vote.

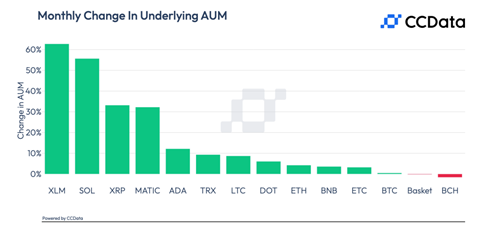

Cryptocurrency investment products focused on three major altcoins – Stellar (XLM), XRP, and Solana (SOL ) – all saw major inflows this month, which led to significant rises in their assets under management (AUM), even though the main surge in assets under management came from Bitcoin (BTC) products.

Leading cryptocurrency exchange Binance has retracted its bid for a crypto license in Germany following reports that the country's financial regulator, BaFin, declined the exchange's application for a crypto custody license.

Top stories in the Crypto Roundup today:

- House Committee Approves Crypto Bill to Clarify SEC Role

- Stellar, Solana, and XRP Investment Funds See AUM Surge

- Binance Drops Crypto License Bid in Germany

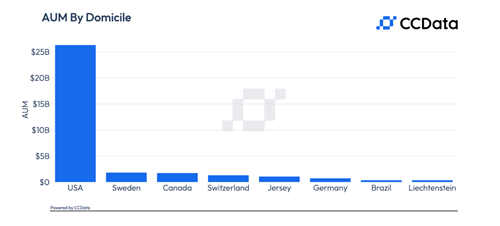

- U.S. Retains its Position as Leading Country by Digital Asset AUM