The European Union has officially signed the landmark regulation known as Markets in Crypto Assets (MiCA) into law, in what is a historical moment for the cryptocurrency sector. The act nudges the EU closer to being the world’s first major jurisdiction with rules crafted for the sector.

Leading cryptocurrency exchange Binance is planning to lay off 20% of its workforce this month, in what the company called a resource reallocation. The move comes after the company said earlier this year it wasn’t planning any layoffs.

Prominent blockchain bridge protocol, Multichain, has seen the problems surrounding it pile up. After speculation arose that Chinese officials detained top executives including its CEO, the protocol has now disclosed that it’s dealing with complications causing disruptions to its cross-chain services and cannot contact its CEO Zhaojun.

Top stories in the Crypto Roundup today:

- European Union Signs Historic Crypto Regulation Law

- Binance Prepares Workforce Reduction in ‘Resource Reallocation’ Move

- Multichain’s CEO Unreachable as Protocol Suffers Node Network Failure

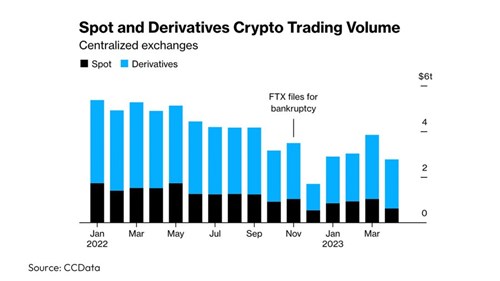

- Derivatives Trading Surges to 78% of Crypto Volume: Gemini Joins the Race with New Exchange