The U.S. Securities and Exchange Commission (SEC) has filed 13 charges against Binance Holdings Ltd., its U.S.-based affiliate BAM Trading Services Inc., and its founder, Changpeng Zhao, alleging violations of securities law.

The SEC has seemingly added a number of new digital assets to the list it deems to be a “security,” to the point there are now 61 digital assets the regulator has accused of being securities.

Google search activity, which can serve as a proxy for retail investor interest, shows that online curiosity about the cryptocurrency industry has been waning in recent months. The trend holds for specific cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

Top stories in the Crypto Roundup today:

- Binance Faces SEC Lawsuit Over Alleged Securities Law Violations

- SEC Has 61 Digital Assets Now Considered Securities

- Google Searches for Crypto and Bitcoin Hit Multi-Month Lows

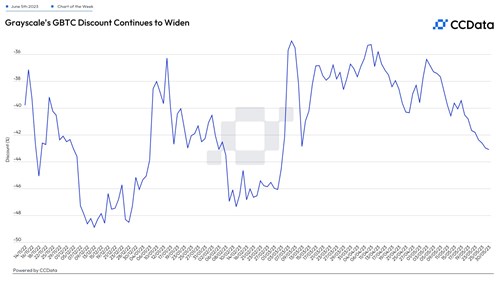

- Grayscale’s GBTC Discount Continues to Widen