U.S. District Judge Amy Berman Jackson has signed a deal between the U.S. Securities and Exchange Commission (SEC), global crypto exchange Binance and its U.S. affiliate to implement steps to ensure only U.S.-based personnel can access customer funds while the case is active.

San Francisco-based cryptocurrency payments firm Wyre is closing its doors after nearly a decade of operation, blaming the financial difficulties of the bear market, with the move reportedly having nothing to do with the strict“regulatory agency direction” in the U.S.

Nasdaq-listed cryptocurrency exchange Coinbase is petitioning for a "mandamus", a legal term for a court order issued by a higher court to a government agency. The order instructs the agency to carry out a particular duty that it is legally bound to fulfill.

Top stories in the Crypto Roundup today:

- SEC and Binance.US Reach Deal to Avoid Asset Freeze

- Crypto Payments Firm Wyre Closes Shop Over Prolonged Bear Market

- Coinbase Petitions for Court Order to Instruct SEC to Define Crypto Rules

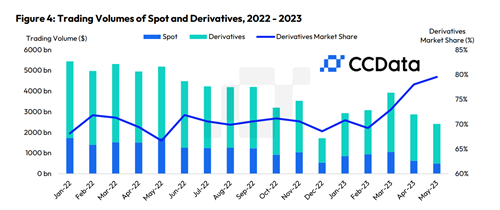

- Regulatory Scrutiny Continues to Influence Centralised Exchanges