Cryptocurrency fund manager Valkyrie Digital Assets has set its sights on establishing a spot Bitcoin exchange-traded fund (ETF), filing an S-1 registration form with the Securities and Exchange Commission (SEC).

Popular decentralized finance protocol MakerDAO, the project behind the cryptocurrency-backed stablecoin DAI, has bought an additional $700 million worth of U.S. Treasurys, bringing the total in its DAI reserve to $1.2 billion.

The Monetary Authority of Singapore (MAS), in conjunction with the International Monetary Fund (IMF), Banca d'Italia, Bank of Korea, financial institutions, and fintech firms, has unveiled proposals for setting standards in the use of digital money.

Top stories in the Crypto Roundup today:

- Valkyrie Files for Spot Bitcoin ETF, Joining Race with BlackRock and Invesco

- MakerDAO Boosts Its DAI Reserve with $700 Million U.S. Treasury Purchase

- Central banks, IMF Collaborate with Amazon and Others on Setting Standards for Digital Money

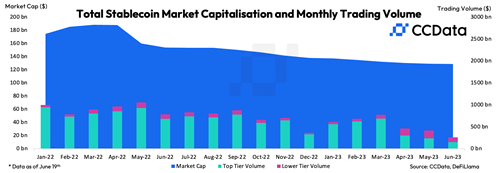

- Stablecoin Market Cap Declines for 15th Consecutive Month