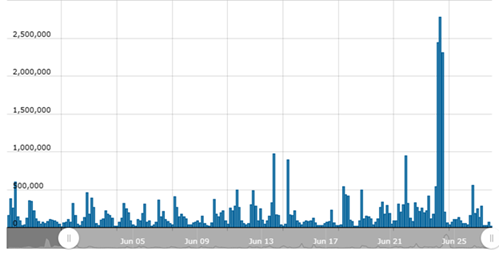

Russians have seemingly moved to change their rubles for popular stablecoin USDT as a refuge during the short-lived mercenary rebellion that saw the Wagner group move against Moscow over the weekend.

Leading cryptocurrency exchange Binance has announced it will keep on supporting trading of several privacy-focused digital assets in the European market, in a move that comes after the firm said it would drop these assets in May.

The Swiss National Bank (SNB) is on the cusp of launching a wholesale central bank digital currency (wCBDC) pilot project, according to the bank’s chair Thomas Jordan, who was quoted saying the project will start “soon.”

Top stories in the Crypto Roundup today:

- Russian Traders Sought Refuge in Tether Amid Mercenary Rebellion

- Binance to Keep Supporting Some Privacy Coins in EU Markets

- Swiss National Bank to Launch Wholesale CBDC Pilot Project

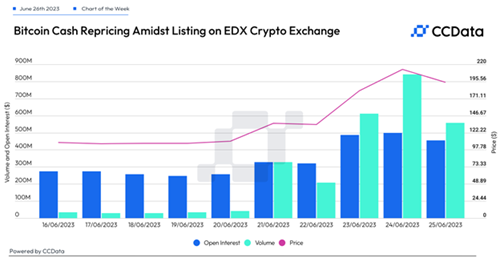

- Chart of the Week: Bitcoin Cash Repricing Amidst EDX Markets Listing